A comprehensive look at the liabilities business and the road ahead

In the constantly evolving banking landscape in Nepal, liability management is becoming a vital issue for banks. The core of the bank’s business is its liabilities, which include deposits, borrowings and obligations. This article delves into the intricacies of the liabilities business for banks in Nepal, highlighting the challenges they face and the strategies needed to overcome them.

In recent years, due to economic expansion and increasing financial awareness among the population, Nepal’s banking sector has experienced significant growth. That growth has resulted in an increase of the bank’s liabilities, especially deposits which constitute a large part of its funding. Banks in Nepal have been successful in attracting funds from a wide range of customers with a variety of deposit products, including savings accounts, fixed deposits and recurring deposits.

Over the past few months, there has been an accumulation of deposits throughout the banking sector which can be witnessed through a CD ratio of 80% on average and reduction of interest rates. On both sides of institutional and individual deposits, many banks do not see immediate threats. However, the battle for retention of existing deposits won’t just be about that. The deposit battle may be more about retaining relationships than just the actual deposit. There is a risk that a bank will lose a long-term valuable customer if it doesn’t require deposits, if there are competitors who do, and if they start to raise their rate. Even if the bank doesn’t need the deposit today, they have to be really careful about not losing that customer completely and putting themselves in a difficult situation over the longer term.

Over the past few months, there has been an accumulation of deposits throughout the banking sector which can be witnessed through a CD ratio of 80% on average and reduction of interest rates. On both sides of institutional and individual deposits, many banks do not see immediate threats. However, the battle for retention of existing deposits won’t just be about that. The deposit battle may be more about retaining relationships than just the actual deposit. There is a risk that a bank will lose a long-term valuable customer if it doesn’t require deposits, if there are competitors who do, and if they start to raise their rate. Even if the bank doesn’t need the deposit today, they have to be really careful about not losing that customer completely and putting themselves in a difficult situation over the longer term.

Despite the growth, banks in Nepal encounter several challenges in managing their liabilities effectively.

Interest Rate Volatility: In Nepal, the volatility of interest rates poses a serious challenge for banks. The costs of funds and the erosion of profit margins may result from sudden changes in interest rates, which can lead to a destabilising effect on the bank as a whole.

Competition for Deposits: The banking sector in Nepal is highly competitive with 20 commercial banks, 17 development banks and 17 finance companies operating in the market as of now. Competition for acquiring and keeping deposits is intensifying as the banking sector becomes increasingly saturated. In order to remain ahead of the competition for customer funds, banks have to innovate products and provide personalised services. Banks have to offer attractive rates and incentives to attract and retain depositors.

Regulatory Compliance: Nepal’s regulatory environment is dynamic, with changes in policies and guidelines having an impact on the business of liabilities. These include the credit to core capital cum deposit (CCD) ratio, the capital adequacy ratio, the liquidity ratio, the deprived sector lending, and the anti-money laundering measures, etc. Banks need to invest in technology and increase operational efficiency in order to comply with the evolving standards of compliance in order to adapt to new regulations.

Technological Integration: The challenge for traditional banks in adapting their infrastructure to meet the demands of technology savvy customers is growing as more and more financial services are being provided online. In order to maintain customer trust and confidence, it is necessary to put in place a robust digital platform and ensure cybersecurity. Customers are becoming more aware and demanding of the quality and convenience of banking services. They are also looking for more digital and innovative solutions, such as mobile banking, internet banking and e-wallets. Banks have to invest in technology and customer service to meet these expectations.

Amidst these challenges, there are also ample opportunities for banks in Nepal to strengthen their liabilities business.

Diversification of Products: New deposit products catering to the different needs of customers can be explored by banks. A wider customer base can be attracted by offering tailored products based on demographic segments and economic trends.

Strategic Partnerships: The bank’s ability to manage liabilities can be enhanced by cooperation with financial technology companies or other financial institutions. Access to new technologies and customer bases can be provided through joint ventures or partnerships.

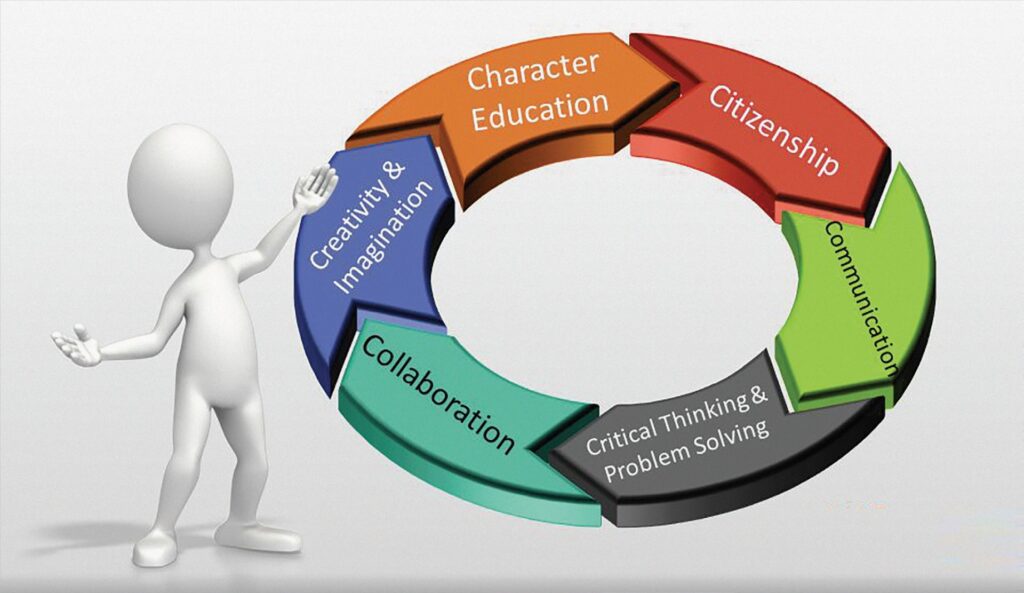

Focus on Customer Education: A more informed and loyal customer base can be created by informing customers about the benefits of different deposit products and their importance for financial planning. Building trust and supporting long-term relationships can be helped by financial literacy initiatives. In Nepal, the financial literacy score is 57.9% only. Financial literacy means the knowledge and skills necessary to make informed and effective decisions regarding the management of personal finances. Banks should also focus on providing financial literacy as one of the tools for deposit marketing. The more financially literate the customers become, the more there will be savings in the bank.

Investment in Technology: Banks need to invest in technology that will streamline their operations and improve the overall customer experience if they are to stay competitive. Attracting younger customers and improving customer retention can be achieved by adopting digital solutions, such as online banking and mobile applications.

It is necessary to strike a careful balance in dealing with challenges and exploiting opportunities when it comes to managing the liabilities business of Nepal’s banking sector. Banks can not only overcome the obstacles but also flourish in Nepal’s dynamic banking landscape as long as they remain efficient, embrace technology and adopt customer centric strategies. To ensure sustained growth and stability in the liability sector, it requires strategic thinking, adaptability as well as a commitment to innovation.

As a Head-Liability Business of Muktinath Bikas Bank, I always focus on managing deposit composition for the bank so that the bank can have sustainable deposits at lower cost. While doing this, my main focus will be on promoting CASA (Current Account – Saving Account) deposit and emphasis on the slogan ‘CASA our PASA’ where PASA means friends in Newari language. A higher CASA ratio indicates that a bank has a higher portion of stable deposits available for lending. Further, it is a cheaper way for a bank to raise money than issuing fixed deposits; which eventually helps to increase the bank’s net interest income (NII), which means better operating efficiency. The only drawback is uncertainty on the withdrawal of the CASA deposit. It doesn’t mean that banks should have higher fixed-term deposits because higher fixed-term deposits mean more uncertainty than it does in the case of CASA deposits. CASA deposits have more transactional features which helps to maintain average deposit throughout the lifetime of the account. However, in a fixed-term deposit, the depositors may or may not renew the terms leaving them vacant in a short span of time. So, the major focus of the bank should be in the marketing of CASA deposits. Our Bank has penned a beautiful slogan to promote savings – “Bachat shabd chhoto Artha mitho”.

Liability marketing is more than offering higher interest rates to the customers. It is about maintaining a professional relationship with the valued customers. Customers don’t only look for the interest rate but also for the service they get from the bank, the relationship they have with the staff of the bank and the branding of the bank itself. In addition, only providing good customer service is not enough in this competitive era, the bank must go the extra mile to delight the customers and make sure that customers leave with happy faces. The only formula for repeat and referral customers are happy customers.

Shakya is Head of Liability Business in Muktinath Bikas Bank Ltd.

Shakya is Head of Liability Business in Muktinath Bikas Bank Ltd.