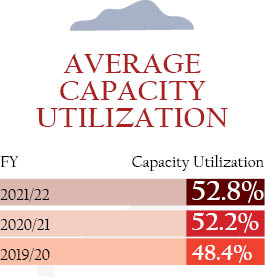

According to NRB’s Economic Activities Report 2021/22, the average capacity utilization of industry nationwide in the last fiscal year was 52.8 percent, up from 52.2 percent in FY 2020/21.

the HRM

the HRM

The protracted liquidity crisis, interest rate volatility, and rise in raw material costs have hit the country’s industrial output in the last fiscal year. A recent study conducted by the Nepal Rastra Bank (NRB) found a marginal increase in the capacity utilization of manufacturing sector companies in the fiscal year 2021/22.

According to the Economic Activities (Integrated) 2021/22 Report published by NRB, the average capacity utilization of industries in the last fiscal year stood at 52.8 percent compared to 52.2 percent in FY 2020/21.

In the past two fiscal years, industrial operation and production activities in the country were hampered by the lockdowns imposed to contain the spread of the Covid-19 pandemic. However, there were no such restrictions in the last fiscal year and yet the capacity utilization of industries increased marginally due to the macroeconomic headwinds.

“It is challenging for industries to raise the necessary financial resources to establish new industries and expand the operational capacity of existing industries due to the liquidity pressure and interest rate fluctuations,” reads the NRB report.

“It is challenging for industries to raise the necessary financial resources to establish new industries and expand the operational capacity of existing industries due to the liquidity pressure and interest rate fluctuations,” reads the NRB report.

According to the report, the rise in fuel prices and raw materials globally has increased the cost of industries relying on foreign raw materials and made it challenging for them to make a profit by selling products in the market.

According to NRB, the capacity utilization of industries producing ghee, processed milk, rice, wheat flour, sugar, chocolate, beer, soft drinks, yarn, jute goods, raw leather, processed leather, sawn wood, plywood, paper, rosin, paint, medicine, and cement has increased in FY 2021/22. There has also been an improvement in the capacity utilization of industries manufacturing iron rods and sheets, steel products, GI pipes, household metal products, aluminum products, electric wires and cables, tires and tubes, footwear, and power generation in the last fiscal year.

However, the capacity utilization of industries producing mustard oil, soybean oil, animal feed, biscuits, noodles, processed tea, alcohol, cigarettes, synthetic fabrics, soap, plastic products, bricks, concrete, GI wire, and slippers declined in the last fiscal year.

In the last fiscal year, the capacity utilization of the cement industry was the highest (93.8 percent), while the lowest was of the pharmaceutical industry, particularly dry syrup producers (9.9 percent).

The report has pointed out the necessity of developing infrastructures such as roads, electricity, and communication to create an investment-friendly environment, and the need to attract foreign investment in the industrial sector for technology transfer and management capacity enhancement. “The places that have the potential for industrial development should be developed as industrial zones,” reads the report.

According to NRB, industrialists are still facing challenges such as the rising cost of establishing an industry due to exorbitant land prices and ensuring the availability of skilled labor by preventing the migration of semi-skilled and skilled manpower.

Effective management and expansion of existing industrial areas/corridors and special economic zones, increasing the production and consumption of indigenous industrial raw materials, making the industrial supply chain effective, creating an investment-friendly environment and increasing investment in export industries having comparative advantage are still existing challenges in the industrial sector.

Industry registration surged by 52%

Industry registration in the country surged by 52 percent in the last fiscal year. The NRB report says a total of 309 industries were registered in the Department of Industry in FY 2021/22 compared to 203 industries in FY 2020/21.

Of the total registration, 131 were registered in Bagmati Province, 51 in Lumbini Province, 48 in Madesh Province, 42 in Province 1, 24 in Gandaki Province, 10 in Sudur Paschhim Province, and 3 in Karnali Province.

Slump in Credit Flow to Industrial Sector

The acute liquidity shortage in the financial system has affected banks’ credit flow to the industrial sector. According to the latest report of the Nepal Rastra Bank (NRB), the total loans of BFIs to the industrial sector slumped by 8.5 percent in FY 2021/22.

The acute liquidity shortage in the financial system has affected banks’ credit flow to the industrial sector. According to the latest report of the Nepal Rastra Bank (NRB), the total loans of BFIs to the industrial sector slumped by 8.5 percent in FY 2021/22.

NRB in its Economic Activities Report (Integrated) 2021/22 reported that BFIs disbursed a total of Rs 1251.96 billion in loans to the industrial sector in the last fiscal year which was Rs 1,367.75 billion in FY 2020/21.

Meanwhile, the extension of loans to the services sector increased by 13.7 percent in the last fiscal year. According to NRB, BFIs disbursed a total of Rs 18,57.14 billion in loans to the service sector borrowers in FY 2021/22.

Of the total loans disbursed by the BFIs in the last fiscal year, 39.6 percent went to the services sector and 26.7 percent to the industrial sector.

Of the total industrial loans, 1.2 percent went to the mining industry, 19.6 percent to agriculture, forestry, and beverage industry, 40 percent to non-food product manufacturing industry, 13.9 percent to construction industry, 19.7 percent to electricity, gas, and water industry and 5.6 percent to metal product, machinery, and electronics industry.

According to the report, Bagmati Province had the highest loan disbursement of Rs 842.66 billion while Karnali Province had the lowest disbursement of Rs 3.67 billion.

The Bagmati Province’s share in industrial loans is a whopping 67.3 percent. According to the report, the share of Province 1 is 9.7 percent, Madhesh Province is 8.2 percent, Gandaki Province is 3 percent, Lumbini Province is 9.5 percent, Karnali Province is 0.3 percent and Sudur Paschhim Province is 2.1 percent.

The report shows, of the total loans disbursed to the services sector, 51.6 percent went to wholesale and retail, followed by 11.8 percent to finance, insurance, and real estate, 10.5 percent to tourism, and 5.5 percent to transport, storage, and communication and 4.2 percent to other services sub-sectors.