After enduring a historic downturn during the Covid-19 pandemic, Nepal’s upscale hotels have experienced a robust recovery in their business.

the HRM

A fter facing severe challenges during the Covid-19 pandemic, hospitality enterprises have shown an impressive resurgence. The financial reports of the last fiscal year of six hotel and tourism companies listed on the Nepal Stock Exchange (Nepse), clearly show that the hospitality industry has significantly recovered from the impacts of the global health emergency.

A fter facing severe challenges during the Covid-19 pandemic, hospitality enterprises have shown an impressive resurgence. The financial reports of the last fiscal year of six hotel and tourism companies listed on the Nepal Stock Exchange (Nepse), clearly show that the hospitality industry has significantly recovered from the impacts of the global health emergency.

Nepal’s prominent five-star hotels have seen significant increases in both their revenue and profitability in the fiscal year 2022/23. A gradual uptick in tourist visits, coupled with a thriving banquet and event business, contributed to these hotels achieving record-breaking profits.

As the effects of the Covid-19 pandemic receded, Nepal saw a surge in tourist arrivals in 2022, reaching a three-year high with 614,148 foreigners visiting the country. This marked a remarkable increase of 306.82 percent in foreign arrivals, effectively ending a two-year decline that commenced in early 2020 when the global coronavirus outbreak began wreaking havoc on the global tourism industry.

The financial reports of both publicly listed and non-listed hotels show their room occupancy and average revenue per available room has improved in the last fiscal year.

Currently, six companies from the hospitality sector are listed in Nepse, and among them, four are five-star hotels. Soaltee Hotel Limited, Taragaun Regency Hotels Ltd, Oriental Hotel Ltd, City Hotels Ltd, Chandragiri Hills Ltd, and Kalinchowk Darshan Ltd are publicly listed companies.

Soaltee Hotel, which is the country’s oldest five-star property, recorded robust growth in its revenue and profit. The company reported a profit of 545.15 million in the last fiscal year, a significant increase compared to the profit of Rs 297.24 million in the previous fiscal year. The company experienced robust growth of 64.28 percent in its business during the last fiscal year. The hotel’s revenue also surged, reaching Rs 2.24 billion in FY 2022/23, up from Rs 1.36 billion in FY 2021/22.

Soaltee Hotel, which is the country’s oldest five-star property, recorded robust growth in its revenue and profit. The company reported a profit of 545.15 million in the last fiscal year, a significant increase compared to the profit of Rs 297.24 million in the previous fiscal year. The company experienced robust growth of 64.28 percent in its business during the last fiscal year. The hotel’s revenue also surged, reaching Rs 2.24 billion in FY 2022/23, up from Rs 1.36 billion in FY 2021/22.

Oriental Hotels, the operator of the five-star Radisson Hotel Kathmandu, reported a profit of Rs 178.43 million in the last fiscal year, a significant turnaround from the loss of Rs 24.60 million in the previous fiscal year. Oriental Hotels also posted a strong revenue growth, with its income increasing to Rs 1.09 billion in FY 2022/23, up from Rs 570.24 million in FY 2021/22.

Taragaon Regency Hotels, which manages the Hyatt Regency Hotel, posted a profit of Rs 382.64 million in the last fiscal year, compared to a profit of Rs 190.55 million in the previous fiscal year. The hotel’s revenue also surged by 99 percent in the last fiscal year, reaching Rs 1.38 billion from Rs 692.62 million in FY 2021/22.

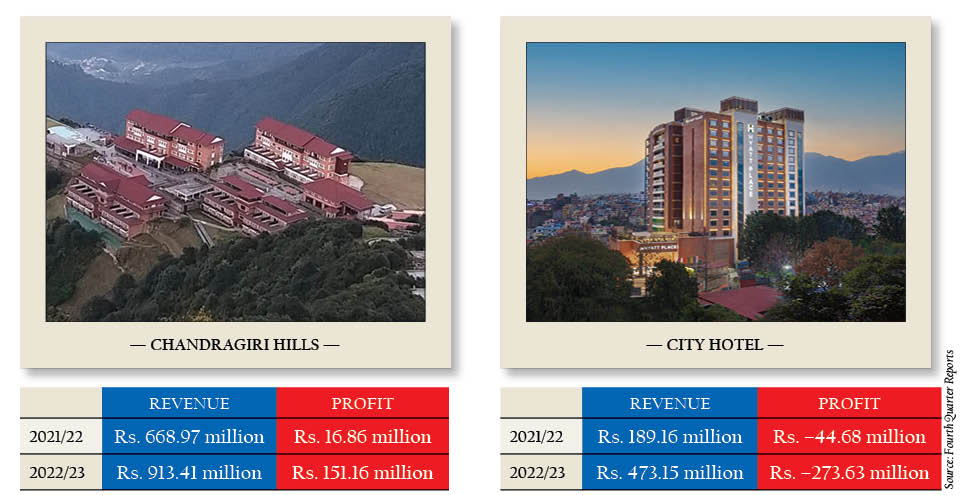

Chandragiri Hills, the company operating a cable car and a luxurious five-star resort in Chandragiri, an emerging tourist destination on the outskirts of Kathmandu, managed a whopping 797 percent growth in its profit. The company’s profit rose to Rs 151.16 million in FY 2022/23, from a profit of Rs 16.86 million in FY 2021/22.

On the other hand, City Hotel, the operator of Hyatt Place Hotel, faced a loss of Rs 273.63 million in FY 2022/23, a notable increase from the loss of Rs 44.68 million in FY 2021/22. However, the company managed to expand its revenue to Rs 473.15 million in the last fiscal from Rs 189.16 million in the previous fiscal.

On the other hand, City Hotel, the operator of Hyatt Place Hotel, faced a loss of Rs 273.63 million in FY 2022/23, a notable increase from the loss of Rs 44.68 million in FY 2021/22. However, the company managed to expand its revenue to Rs 473.15 million in the last fiscal from Rs 189.16 million in the previous fiscal.

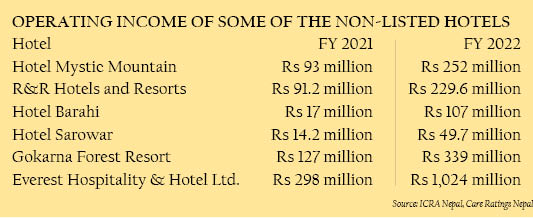

The performance of unlisted hotel companies is equally noteworthy. Information obtained from credit rating agencies indicates that these unlisted hotel companies experienced a significant increase in their operating income in 2022. Everest Hospitality & Hotel Limited, the company managing Hotel Marriot in Kathmandu, saw a substantial rise in its operating income, reaching Rs 1.02 billion in 2022, compared to just Rs 298 million in 2021.

R&R Hotels and Resorts Private Limited (R&R), the proprietor and operator of Vivanta Kathmandu, a 4-star establishment located in Jhamsikhel, Lalitpur, has disclosed an impressive 151.75 percent surge in its operating income for the year 2022. According to credit rating agency ICRA Nepal, R&R Hotels achieved an operating income of Rs 229.6 million in 2022, marking a substantial increase from the Rs 91.2 million reported in 2021.

Gokarna Forest Resort Private Limited, which oversees a boutique resort with 100 rooms and an 18-hole golf course on the outskirts of Kathmandu, successfully increased its operating income by an impressive 166.92 percent in 2022.

According to hoteliers, the domestic hospitality sector is experiencing a significant revival at present. After the World Health Organization (WHO) declared an end to Covid-19 as a global health emergency in May this year, more international travelers are going to tourist destinations. This renewed trust is contributing to a gradual rebound in both occupancy rates and revenue, say tourism entrepreneurs.

Sudarshan Chapagain, Vice-President of Soaltee Hotel Limited, remarked that there has been a substantial surge in the number of hotel guests lately. He attributed this growth to a combination of enhanced operational efficiencies and a focused revenue strategy. Chapagain noted that Soaltee Hotel consistently achieved an impressive 70 percent occupancy rate throughout the last fiscal year, and there are promising bookings for the upcoming tourist season. He also expressed optimism, stating that bookings for the next season are expected to maintain a 70 percent rate, which is an encouraging sign.

“After enduring two challenging years, the hospitality sector is displaying promising signs, and if these numbers continue, we will be on the right track,” he added.

Soaltee Hotel Limited has recently expanded its presence to Itahari, Nepalgunj, and Chitwan, and they are planning to introduce three more properties in Pokhara, Nagarkot, and Simara.

With an optimistic outlook, international hotel chains are also expanding their presence in Nepal. Two years after its departure from Nepal, the British multinational hospitality company IHG Hotels & Resorts is reentering the country with a more extensive presence. This time, IHG has partnered with Shangri-La Hotel and Resort Group, a prominent hospitality group in Nepal, through a management agreement to develop four new hotel properties in Nepal. Previously, IHG had a management collaboration with the five-star Soaltee Hotel, which concluded in May 2021.

The new hotels resulting from the partnership with the Shangri-La Group include InterContinental Kathmandu in Lazimpat, Hotel Indigo in Gharipatan, Pokhara, InterContinental Resort in Begnas Lake, Pokhara, and InterContinental Resort in Meghauli, Chitwan. Through this agreement, IHG is set to add nearly 500 rooms to its portfolio in Nepal. Additionally, two of IHG’s global brands, InterContinental and Hotel Indigo, will make their debut in the Nepali market. These new hotels are currently under construction and are expected to open over the next 1-4 years.

While travel trade entrepreneurs remain bullish about the upcoming tourism season, they also point out that there are still various obstacles ahead for the sector. One of the worrying factors is the decline in spending and the average duration of tourists’ stay in Nepal. According to the ‘Nepal Tourism Statistics-2022’ report released by the Ministry of Culture, Tourism, and Civil Aviation, both spending and average stay has reached the lowest levels in three years in 2022. The average tourist stay in 2022 has fallen to 13.1 days. In 2021, the average length of stay reached a ten-year high at 15.5 days. As tourists are now spending less time in Nepal, their expenditure has also decreased in 2022. The average daily spending by tourists has dropped to USD 40 per day, compared to USD 48 per day in 2021.

The hospitality industry has experienced a resurgence and is expected to continue growing in the coming year. However, the challenge lies in the expenditure of tourists. The majority of expenditures are concentrated in Kathmandu, and outside of the Kathmandu Valley, spending is comparatively lower. This has become our biggest concern in recent times,” said Sishir Khanal, Vice President of Nepal Association of Rafting Agencies (NARA).

While five-star properties in Kathmandu are enjoying robust growth, the same cannot be said about hotels outside Kathmandu. Hotels in Pokhara, the major tourist hotspot outside Kathmandu are experiencing a mere 35 percent occupancy. The hotel in Pokhara is yet to reap the benefit of having the country’s third international airport. Entrepreneurs point to several factors contributing to this decline. According to Laxman Subedi, President of the Pokhara chapter of Hotel Association Nepal (HAN), there are two primary factors contributing to a significant decline in tourism in the region. “First, the tragic air crash in Pokhara in January discouraged many tourists from choosing air travel to visit the city. Second, the deteriorating condition of the road linking Pokhara and Kathmandu further discouraged tourists from making their journey to Pokhara. These issues are having adverse impacts on the local tourism industry,” said Subedi.

While five-star properties in Kathmandu are enjoying robust growth, the same cannot be said about hotels outside Kathmandu. Hotels in Pokhara, the major tourist hotspot outside Kathmandu are experiencing a mere 35 percent occupancy. The hotel in Pokhara is yet to reap the benefit of having the country’s third international airport. Entrepreneurs point to several factors contributing to this decline. According to Laxman Subedi, President of the Pokhara chapter of Hotel Association Nepal (HAN), there are two primary factors contributing to a significant decline in tourism in the region. “First, the tragic air crash in Pokhara in January discouraged many tourists from choosing air travel to visit the city. Second, the deteriorating condition of the road linking Pokhara and Kathmandu further discouraged tourists from making their journey to Pokhara. These issues are having adverse impacts on the local tourism industry,” said Subedi.

Tourism entrepreneurs say creating conditions that incentivize foreign visitors to prolong their stays has become of paramount importance. They assert that there is an urgent need for the improvement of tourism infrastructure. Despite the increase in the number of five-star and four-star hotels in the country, challenges persist in terms of diversifying products and services. Binayak Shah, President of the Hotel Association of Nepal, noted, “There is a bottleneck in tourism infrastructure, and Tribhuvan International Airport is presently incapable of accommodating a larger influx of tourists.”

Shah further pointed out that the potential of the country’s two recently constructed international airports Pokhara and Bhairahawa remains largely untapped because there are currently no regular international flights operating to and from these locations.