Drawn by the appeal of intelligent and cost-effective mobility, Nepali consumers are increasingly choosing Chinese electric vehicle brands due to their affordability, ergonomic design, and advanced battery technology.

the HRM

the HRM

I n the last week of September, Chaudhary Group (CG), which currently represents three Chinese electric vehicle (EV) brands including NETA Auto, concluded agreements with two other EV manufacturers from China to distribute their automobiles in Nepal. Nirvana Chaudhary, Managing Director of CG, signed the deals with representatives of GAC Aion and Smart Automobile to allow the EV makers to promote their products in the Nepali market.

CG’s eagerness to expand its portfolio of EVs is well-justified, given the rising preference of Nepali automotive consumers for EVs over internal combustion engine (ICE) vehicles. Additionally, the growing expertise of Chinese EV manufacturers in smart mobility solutions further underscores the strategic move of the Nepali business conglomerate.

The NADA Auto Show 2023, which took place from September 12 to 17, clearly indicates the increasing popularity of EVs among buyers.

After a hiatus of three years, the flagship automobile show not only infused crucial vitality into the nation’s automotive industry, which had weathered a tumultuous period in the past two years but also highlighted a significant change in urban consumers’ inclinations towards EVs.

Among the 1,000 vehicles booked during the auto show, a noteworthy 700 were electric vehicles, with Chinese EVs taking center stage and attracting large crowds.

Among the 1,000 vehicles booked during the auto show, a noteworthy 700 were electric vehicles, with Chinese EVs taking center stage and attracting large crowds.

This year’s NADA Auto Show saw the prominence of EVs over ICE automobiles, occupying 65 percent of the exhibition space. According to Dhruba Thapa, President of NADA Automobiles Association of Nepal, Chinese brands are behind the growing dominance of EVs in the domestic automobile market. China’s leadership in EV technology, particularly in battery technology and car electronics, played a crucial role in this trend.

The auto show was marked by the introduction of several new Chinese EVs. Cimex Inc., the authorized distributor of BYD in Nepal, launched the BYD Dolphin crossover. Additionally, MG Motors launched two new models before the auto show, namely the MG 4 and the compact city car MG Comet.

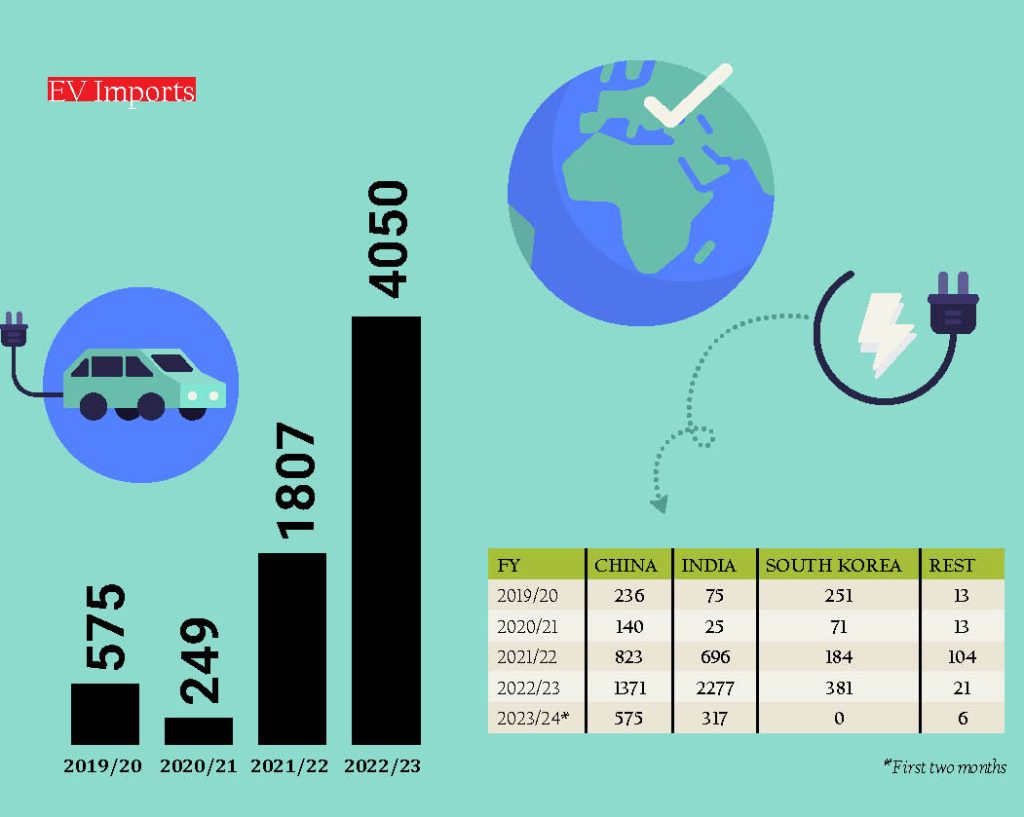

Among other factors, the surge in the sales of EVs over the past two years can be primarily attributed to a significant hike in fossil fuel prices. With petrol and diesel prices skyrocketing after the start of the Russia-Ukraine war, the popularity of EVs surged worldwide as consumers looked for cost-efficient mobility solutions. In FY 2022/23, Nepal imported 4,050 EVs which is double from FY 2021/22 when 1,807 electric four-wheelers were imported. Data published by the Department of Customs shows the last fiscal year saw the import of 6,914 electric three-wheelers.

Besides, stringent policies of banks and financial institutions (BFIs) regarding auto loans for ICE vehicles have also played a part in the increasing adoption of EVs. With BFIs typically financing only 50 percent of the total value for ICE vehicles, consumers have turned to EVs as they can avail of up to a 90 percent loan facility. This favorable financing arrangement has acted as a compelling factor driving the growing preference for EVs in the market.

A Competition for Brand Representation

Nepal’s prominent business houses that traditionally focused on sales of ICE vehicles are undergoing a noteworthy transition towards EVs. Major corporate houses in Nepal, previously engaged in American, Japanese, and European car sales, are progressively forming partnerships with Chinese EV manufacturers. While maintaining their involvement in the ICE vehicle sector, these business groups are strategically expanding their footprint in the rapidly growing EV segment.

Chinese automotive brands that initially entered Nepal roughly fifteen years ago in the ICE segment and failed to achieve success are now leading the race for the market.

Over the past two years, Nepali automobile dealers have been importing EVs in premium and general categories from various international brands including Tesla, Audi, Jaguar, Citroen, and Peugeot, Hyundai, Kia, Nissan, Tata, Mahindra, BYD, Great Wall Motors, Neta, and MG. However, 2023 not only witnessed a surge in imports of EVs from China but also marked the introduction of additional Chinese EV brands.

Over the past two years, Nepali automobile dealers have been importing EVs in premium and general categories from various international brands including Tesla, Audi, Jaguar, Citroen, and Peugeot, Hyundai, Kia, Nissan, Tata, Mahindra, BYD, Great Wall Motors, Neta, and MG. However, 2023 not only witnessed a surge in imports of EVs from China but also marked the introduction of additional Chinese EV brands.

MAW Enterprises, for instance, recently introduced a new Chinese EV brand Seres. Launched at the NADA Auto Show, Seres stands out as one of the pioneering Chinese automakers making inroads into the European market.

Another player entering the Nepali EV segment is SPG Automobiles, a subsidiary of Sharda Group, currently known for selling Chery cars in Nepal. SPG is gearing up to bring Omoda EVs to the Nepali market, expanding its presence in the electric vehicle domain.

CG, a significant player in this transition, has already incorporated five Chinese EVs into its portfolio. Similarly, Vishal Group is not lagging, having added two Chinese EV brands – Ora and MG – to its offerings. This trend underscores Chinese electric vehicle manufacturers’ growing influence and diversity in the Nepali automotive landscape.

Chinese Dominance in Passenger Car Segment

Chinese EVs are solidifying their supremacy in the Nepali automotive market, as evidenced by recent statistics showcasing a substantial increase in their imports. Over the past two months, 575 Chinese EV units have been imported from China, highlighting their popularity among Nepali consumers.

The passenger car segment in EVs was initially led by South Korean brands Hyundai and Kia some 3-4 years ago. However, Chinese and Indian EVs left behind South Korean brands in 2020-21. The introduction of Tata Nexon, a compact electric SUV from India changed the market scenario. In 2022, Indian EVs ruled the market with Tata Nexon in the pole position. However, starting this fiscal, Chinese EV brands are again in the driving seat. Data from the Department of Customs points explicitly to the strong presence of Chinese EV brands such as BYD and MG among the imported vehicles, underscoring their dominance in the Nepali market.

Looking at the current situation in the market, Indian brands that previously held a prominent position in Nepal, are poised to take a backseat this year. 317 EVs were imported from India in the past two months, with a noteworthy portion arriving in Nepal in August.

According to industry stakeholders, Chinese automakers have taken a leading role in EV development, offering a diverse range of models that boast cutting-edge technology, impressive performance, and competitive pricing.

Vivek Sikaria, Managing Director of MAW Vriddhi Commercial Vehicle, emphasizes that Chinese EVs currently dominate 65 percent of the Nepali EV market. Sikaria points to the advanced features of Chinese EVs, setting them apart from competitors. He highlights China’s rapid technological progress, impacting various industries and resulting in cost-effective vehicle production. Sikaria notes that even vehicles manufactured in countries like India become pricier due to the reliance on Chinese-imported batteries compared to their Chinese counterparts.

Sikaria mentions his company’s success in securing bookings for 334 Seres, with an additional 65 bookings received post-NADA Auto Show. He expresses enthusiasm for these numbers, signaling a positive trend in the market for Chinese EVs.

EV importers in Nepal are optimistic about the future of electric mobility in the country. Sachin Aryal, General Manager at MG Motors, anticipates total EV sales, including commercial EVs, to reach around 10,000 units in the current fiscal year. Aryal expresses satisfaction with the response received at the auto show, highlighting over 200 bookings made during the event.

EV importers in Nepal are optimistic about the future of electric mobility in the country. Sachin Aryal, General Manager at MG Motors, anticipates total EV sales, including commercial EVs, to reach around 10,000 units in the current fiscal year. Aryal expresses satisfaction with the response received at the auto show, highlighting over 200 bookings made during the event.

Sabita Chhetry, Business Head at “thee GO,” the distributor of thee GO passenger and commercial EVs, emphasizes the cost advantage of Chinese EVs over their Indian counterparts, making the former increasingly appealing to Nepali consumers.

Chhetry notes the approval of electric vehicles by both the government and consumers, contributing to a notable transformation in the automotive market. She sees the adoption of EVs as an opportunity for substantial savings on petroleum products, especially considering Nepal’s limited foreign exchange reserves. “This transition is seen as a feasible solution for the nation, providing advantages for ordinary consumers and the government through significantly reduced operating costs associated with EVs, leading to decreased fuel and petroleum imports,” said Chhetry.

Growing Dominance in the Commercial Segment

Chinese players continue to dominate the light commercial EV segment, witnessing a shift in the preferences of many public transport companies across various cities in Nepal, including Nepalgunj, Surkhet, Birgunj, Dhangadi, Mahendranagar, Kathmandu, Pokhara, and Butwal.

Sajha Yatayat, Nepal’s foremost public bus service provider, has already incorporated 40 Chinese EV buses into its fleet operating in the capital city.

In the microbus segment, Chinese EV models such as thee GO, KYC Changan, and King Long are working to make their presence felt.

Sabita Chhetry of thee GO notes that their 11-seater microbus, marketed in Nepal, has already gained popularity. The microbus serves routes connecting Kathmandu with nearby cities like Sindhuli and Dhading. thee GO has ambitious plans, aiming to sell more than 500 units of the microbus this year. This trend further underscores Chinese electric vehicles’ increasing traction and acceptance in Nepal’s public transportation sector.

Manufacturing Plans

An authoritative source within the EV industry, speaking on condition of anonymity, has disclosed that eight Chinese investors are contemplating the establishment of assembly plants in Nepal to produce EVs. This ambitious plan encompasses the manufacturing of two-wheelers, three-wheelers, and four-wheelers.

Government officials have confirmed that Chinese investors have submitted proposals for EV manufacturing projects that they are looking to start primarily in the Kathmandu Valley and the neighboring Kavre district. Notably, one investor group intends to invest Rs 250 million in setting up a factory in Lalitpur. This facility aims to assemble 5,000 two-wheelers and 2,500 electric rickshaws (three-wheelers) annually.

Another consortium of five Chinese investors plans to allocate the same amount to establish a factory in Kathmandu to produce 3,500 scooters and 3,000 rickshaws yearly. Multiple investor groups share similar ambitions, with proposed investments ranging from 30 million to 400 million Nepali Rupees for diverse electric vehicles. This initiative signifies a significant stride towards bolstering Nepal’s local electric vehicle manufacturing landscape.