Introduction:

Nepal is an evolving nation in the automobile industry, where new technologies are emerging and consumer preferences are shifting. In this changing scenario, every company aspires to lead its segment in both market presence and profitability. However, financial growth is merely an outcome; it is not the foundation.

The automobile distribution chain in Nepal typically follows a manufacturer → distributor → dealer → consumer model, largely due to the country’s smaller market size and population of around 30 million.

In the two-wheeler segment, small-scale assembly plants have emerged with technical support from parent companies. However, the four-wheeler sector, along with other categories, still relies heavily on imports from third countries. The real essence of management in this sector lies not just in selling vehicles, but in shaping business models, developing strong distribution systems, and ensuring long-term competitiveness.

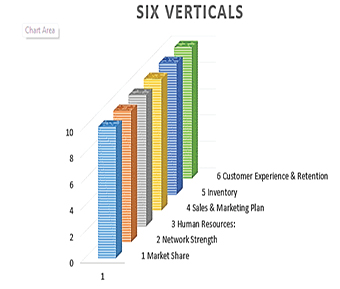

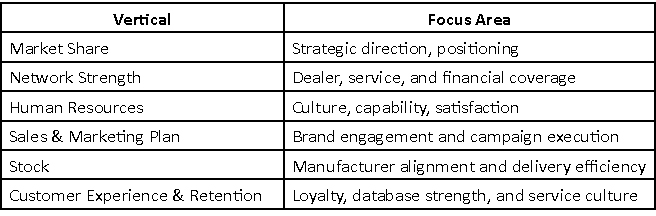

From my 25 years of professional experience in the industry, I have learned that while securing a company’s financial health is vital, non-negotiable, and indeed the strength of the organisation, we must also recognise that strengthening this foundation requires a deeper focus. The real emphasis lies in six strategic verticals that shape long-term relevance. These verticals are the true drivers of sustainable advantage, stronger relationships, continuous innovation, and organisational resilience. By prioritising them, a company can establish itself firmly in the market, whether as a distributor or dealer, building a strong and enduring business presence.

In this article, I present six strategic verticals that every automobile company in Nepal should prioritise to achieve long-term relevance, operational excellence, and sustainable profitability.

In this article, I present six strategic verticals that every automobile company in Nepal should prioritise to achieve long-term relevance, operational excellence, and sustainable profitability.

Each of these six strategic verticals plays a critical, interconnected role in running a successful automobile business:

1. Market Share: The Strategic Destination

1. Market Share: The Strategic Destination

Market share is the north star of every business strategy. It’s not just a number, it reflects the brand’s strength, relevance, and execution capability in the market.

- Why It Matters:

A growing market share boosts visibility, confidence, and competitiveness. A declining share signals internal weaknesses or external threats.

Strategy Points:

– Deep consumer insights into urban and rural preferences.

– Regular market analysis and benchmarking.

– Alignment of all other verticals toward increasing share.

Support Subunits:

Development of channel partners such as recondition houses, exchange shoppes, and private workshop owners, who can act as indirect sales and influence agents.

2. Network Strength: The Foundation of Delivery

2. Network Strength: The Foundation of Delivery

A strong, widespread, and efficient dealer/service network determines how well a brand reaches and supports its customers.

What It Includes:

– Dealers and Sub-Dealers: Footprint coverage and brand execution.

– After-Sales Service & Spares: Key to customer retention and brand reliability.

– Finance Facilities: Offering easy finance at all touchpoints makes ownership more accessible and supports volume growth.

Strategy Points:

– Create a Network Strength Index (NSI) for internal auditing.

– Build partnerships with private service workshops in rural areas.

– Integrate finance partners into dealership operations for smooth customer facilitation.

3. Human Resources: The Soul and Culture

No vertical is successful without a committed and empowered team. Human capital drives brand behaviour, customer experience, and internal innovation.

What to Focus On:

– Recruitment based on integrity, skills, and emotional resilience.

– Leadership development for mid and frontline roles.

– Maintaining a workplace of fairness, recognition, and growth.

Strategy Points:

– Build transparent career paths and internal promotion systems.

– Encourage emotional and mental well-being initiatives.

– Conduct regular satisfaction and capability assessments.

4. Sales & Marketing Plan – The Strategic Engine

A robust sales and marketing plan does more than generate transactions, it fuels demand, builds excitement, and cultivates loyalty. To be effective, it must be tightly aligned with consumer motivations and the company’s strategic identity.

Key Framework:

– Why: Define clear objectives that strengthen and reinforce the brand.

– How: Design the flow of activities like pre-launch buzz, campaign execution, and post-sale engagement.

– When & Where: Align efforts with seasonal trends, regional opportunities, and digital platforms.

– Who: Engage key role models and influencers, top-performing dealers, sales champions, and digital brand ambassadors.

Strategy Points:

– Design location-specific campaigns targeting different segments.

– Train dealers on campaign intent and digital integration.

– Create a feedback loop from the market to modify ongoing campaigns.

5. Inventory: The Operational Backbone

Stock availability is a direct link to customer satisfaction and profitability. Efficient stock management reflects good manufacturer relationships and internal forecasting discipline.

What It Involves:

– Timely delivery and model mix planning.

– Balancing fast-moving vs slow-moving variants.

– Ensuring product decency (colours, trims, feature preferences).

Strategy Points:

– Develop a rolling stock plan based on seasonal trends.

– Weekly manufacturer communication for flexibility and clarity.

– Monitor inventory ageing and transfer logic across branches.

6. Customer Experience & Retention: The Long-Term Value Driver

Selling is only the start. Retention and delight ensure lifetime value and brand advocacy. In a market like Nepal, where referrals and community reputation matter, this vertical is essential.

Key Aspects:

– Build and maintain a centralised customer database.

– Offer structured loyalty programmes and referral incentives.

– Focus on service quality, customer issue resolution, and emotional satisfaction.

Support Subunits:

Support Subunits:

– Involve private workshops and exchange platforms to extend service touchpoints.

– Ensure customer interactions are digitally tracked and followed up.

– Use data analytics to understand preferences, trends, and risk of attrition.

Strategy Points:

– Track Net Promoter Scores (NPS) across regions.

– Establish a Customer Relationship Management (CRM) system covering sales and after-sales.

– Make customer delight a cultural KPI across all departments.

Conclusion: Orchestrating Vertical Excellence

Running an automobile business is like driving a complex machine – every part has to work in harmony. These six strategic verticals are not isolated checklists, but interconnected levers that, when aligned, build long-term success.

When these six verticals are developed with equal care, a company is not only able to survive in a competitive market but also create a strong, enduring presence. Financial health remains the foundation, but it is these verticals that provide the strength to stand tall, move forward, and grow sustainably in Nepal’s evolving automobile industry.

- Market Share gives direction and defines how the company is positioned in the market.

- Network Strength ensures that dealers, service centres, and financial partners are well-connected to support growth.

- Human Resources build the right culture, skills, and satisfaction that keep people motivated and capable.

- Sales & Marketing Plans act as the engine, creating excitement around the brand and ensuring campaigns connect with customers.

- Stock Management keeps the supply chain smooth, ensuring that what the manufacturer delivers reaches the market efficiently.

- Customer Experience & Retention hold everything together by building trust, loyalty, and repeat business.

Baral is Executive Director at MAW Pvt. Ltd. -Yamaha Nepal. He is PhD Scholar in Management and Founder of Eco Polymers Pvt. Ltd.