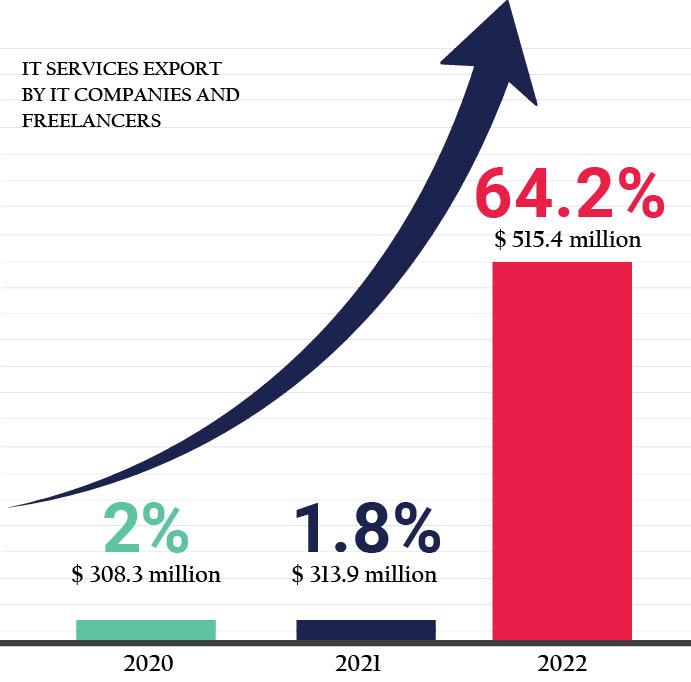

The surge in software development and digital services through offshore outsourcing may be considered one of the most under-the-radar developments to have occurred in the country in recent times. Nepal’s exports of IT services in 2022 amounted to USD 515.4 million, making it the country’s top exportable product.

the HRM

On July 17, the Ministry of Industry, Commerce, and Supplies rolled out the Nepal Trade Integration Strategy (NTIS) 2023. It is the fourth blueprint through which the government aims to enhance Nepal’s exports. Identifying new priority goods and services with comparative advantage for exports, NTIS 2023 broadened the scope of the country’s exportable products by expanding the list from 12 to 32. Among the new entrants to this list are Information Technology (IT) and internet-based services that include Business Process Outsourcing (BPO), and IT engineering.

On July 17, the Ministry of Industry, Commerce, and Supplies rolled out the Nepal Trade Integration Strategy (NTIS) 2023. It is the fourth blueprint through which the government aims to enhance Nepal’s exports. Identifying new priority goods and services with comparative advantage for exports, NTIS 2023 broadened the scope of the country’s exportable products by expanding the list from 12 to 32. Among the new entrants to this list are Information Technology (IT) and internet-based services that include Business Process Outsourcing (BPO), and IT engineering.

Just two weeks later, the Institute for Integrated Development Studies (IIDS), a think tank based in Kathmandu, made an astonishing revelation: Nepal’s exports of IT services in 2022 amounted to USD 515.4 million, making it the country’s top exportable product.

The IIDS report, titled “Unleashing IT: Advancing Nepal’s Digital Economy” cast light upon a reality well-known to the people in the Nepali IT industry, yet remained largely unknown to policymakers, bureaucracy, and the general public.

This is primarily because the government had minimal involvement in promoting and facilitating the IT sector, and the steady progress achieved by the domestic IT industry can be largely attributed to the initiatives of those pioneering Nepali tech entrepreneurs who got into business in the 1990s and 2000s. The surge in software development and digital services through offshore outsourcing may be considered one of the most under-the-radar developments to have occurred in the country in recent times.

It was in 1982 when a company named Data System International (DSI), a Nepal-US joint venture, was established to provide software solutions and BPO services to its clients in other countries, making the company the first exporter of IT services in Nepal. Fast forward four decades and the Nepali IT industry has gone through monumental shifts to become a high-potential sector awash with innovation and disruptions.

It was in 1982 when a company named Data System International (DSI), a Nepal-US joint venture, was established to provide software solutions and BPO services to its clients in other countries, making the company the first exporter of IT services in Nepal. Fast forward four decades and the Nepali IT industry has gone through monumental shifts to become a high-potential sector awash with innovation and disruptions.

In a country where readymade garments, pashmina, woolen carpets, handicraft items and edible oils have traditionally been major export commodities, the emergence of IT services as a novel export category represents a pivotal moment, especially considering that the government’s official data has yet to acknowledge IT services as export items.

In a country where readymade garments, pashmina, woolen carpets, handicraft items and edible oils have traditionally been major export commodities, the emergence of IT services as a novel export category represents a pivotal moment, especially considering that the government’s official data has yet to acknowledge IT services as export items.

Tech entrepreneurs and experts say that with the advent of technology enabling a broader range of services to be traded internationally, Nepal has the chance to shift its focus from exporting labor to exporting services. They assert that this shift not only aids in retaining local talent but also creates job prospects for the younger generation, effectively addressing the issue of brain drain. “The IIDS report reveals some intriguing statistics, such as the presence of over 60,000 freelancers and more than 100 companies in Nepal’s IT sector. The most promising opportunity lies in the continuous expansion of the freelance workforce. The figures in the report are specific to the formal sector which currently amounts to USD 500 million,” said Bal Krishna Joshi, Co-founder of Machnet Technologies Inc. and Thamel Remit. The tech veteran says that considering both the formal and informal sectors together, the industry’s size could exceed 1.5 billion dollars which showcases the significant potential of the domestic IT sector.

Richan Shrestha CEO of Quickfox Technologies is of the opinion that despite these advancements, Nepal currently is in what can be termed as ‘Phase 1’ of its IT market development. “In order to progress into ‘Phase 2’ and unlock the full potential of the market, significant investments are essential, necessitating collaboration between the private sector and government,” he said. Shrestha, who is also the President of the Nepal Association for Software & IT Services Companies (NAS-IT), suggested that partnering with larger corporations can offer stability, especially as long-term contracts become increasingly common, in contrast to the current situation where companies often face uncertain work opportunities from year to year. Established in early 2023, NAS-IT is the first software association in Nepal, to promote and support tech startups by providing mentorship.

Growing Competitiveness and Competence

The fact that Nepali IT companies cater to the likes of global companies based in the US, Europe, and Japan speaks volumes about the capacity of home-grown tech companies. Industry insiders said companies based in Kathmandu are working for global giants such as Boeing and Airbus as well as a leading e-commerce company in Japan.

The likes of Cedar Gate, FuseMachines, Leapfrog Technology, Dearwalk, Logpoint Nepal, Ekbana, Cloud Factory, InfoDevelopers, and Rara Labs among others, have been serving their global clients for many years now.

The IIDS report states that 77.8 percent of IT companies receive assignments from the United States, followed by Europe, the United Kingdom, and Australia. In recent years, the market for Nepali tech firms has started to shift with more companies working for their clients in Asian and Middle Eastern countries such as the United Arab Emirates, Bahrain, Bangladesh, Bhutan, Indonesia, Japan, South Korea, Malaysia, Singapore, and Thailand. The primary areas of export services provided by Nepali IT companies include programming, coding, design, software development, and testing. A significant majority (78 percent) of the companies receive project-based work, although they express a desire for long-term assignments despite currently taking on monthly or hourly task-based work. Around 58.3 percent of the companies frequently receive export services work while 12.3 percent of the companies only receive occasional assignments. InfoDevelopers is one such company that is going into new markets for its services. “We have now expanded our services to international markets, emphasizing insourcing over outsourcing. This approach entails developing solutions in-house and exporting them beyond Nepal,” said, Umesh Raghubansi

The IIDS report states that 77.8 percent of IT companies receive assignments from the United States, followed by Europe, the United Kingdom, and Australia. In recent years, the market for Nepali tech firms has started to shift with more companies working for their clients in Asian and Middle Eastern countries such as the United Arab Emirates, Bahrain, Bangladesh, Bhutan, Indonesia, Japan, South Korea, Malaysia, Singapore, and Thailand. The primary areas of export services provided by Nepali IT companies include programming, coding, design, software development, and testing. A significant majority (78 percent) of the companies receive project-based work, although they express a desire for long-term assignments despite currently taking on monthly or hourly task-based work. Around 58.3 percent of the companies frequently receive export services work while 12.3 percent of the companies only receive occasional assignments. InfoDevelopers is one such company that is going into new markets for its services. “We have now expanded our services to international markets, emphasizing insourcing over outsourcing. This approach entails developing solutions in-house and exporting them beyond Nepal,” said, Umesh Raghubansi

CEO of InfoDevelopers. “We have operations in Bhutan and Myanmar, where microfinance banks in Bhutan and a bank in Myanmar are using our Pumori software. We are also exploring opportunities to further expand our presence in East Asian countries.”

According to Manoj Ghimire, Co-founder and CEO of Rara Labs, while the report has shed light on positive developments in Nepal’s IT sector, the actual size of the IT industry is even bigger. “The actual size of the IT market exceeds the figures presented in the report,” said Ghimire. “When we consider the industry as a whole, encompassing both the local and international markets, the scale becomes even more significant. When we factor in both the domestic and export components, the actual size of the IT industry exceeds USD 2 billion. This represents a remarkable growth trajectory for Nepal’s IT sector.”

Nepal has a considerable number of IT companies catering to both domestic and international markets. There are 7,637 companies registered at the Office of the Company Registrar under the categories of computer hardware, computer software, data processing, computing, communication, technology, outsourcing, all database-related, data services of finance, statistical, computer-related, online business, e-commerce, service and repair, and others. Out of this, 6900 are registered under the tax system.

Nepal’s Top Export Items

It is evident from the IIDS report that IT services have become Nepal’s leading export sector. The report clearly indicates that the export of IT services has surpassed the traditional export items of Nepal.

In 2022, Nepal’s IT services exports reached an impressive USD 515.4 million, while data from the Trade and Export Promotion Center (TEPC) identifies soybean oil as the country’s primary export commodity, with an export value of USD 177.65 million.

However, what sets IT services exports apart is the significant value addition they entail. Edible oil exports from Nepal typically lack substantial value addition, whereas IT services exports boast the highest level of value addition. This distinction significantly enhances the value of IT services exports.

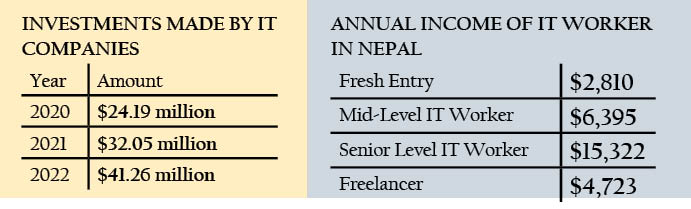

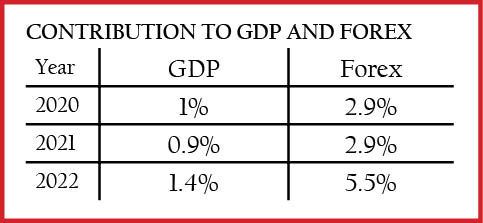

The report highlights a remarkable 64.2 percent growth in IT services exports during 2022. “Both IT companies and freelancers experienced substantial growth, with IT companies achieving an 80.5 percent increase in service exports and freelancers witnessing a growth rate of 55.2 percent,” reads the report. In 2022, IT service exports contributed 1.4 percent to the country’s GDP and accounted for 5.5 percent of its foreign exchange reserves.

The robust growth in exports signifies that a substantial number of companies are successfully providing IT services to international clients, resulting in a greater influx of foreign exchange into the country. The report concludes, “This not only contributes to overall economic development but also underscores the competitiveness and quality of IT services offered by Nepali companies.”

The robust growth in exports signifies that a substantial number of companies are successfully providing IT services to international clients, resulting in a greater influx of foreign exchange into the country. The report concludes, “This not only contributes to overall economic development but also underscores the competitiveness and quality of IT services offered by Nepali companies.”

According to the IIDS report, in 2020, the average export amount for an individual was USD 0.96 million which increased by 20 percent in 2021 to USD 1.1 million. In 2022, the exports surged by 99 percent to reach USD 1.9 million.

Growing Attraction

The report strongly emphasizes that Nepal’s IT sector represents a rapidly growing, previously untapped opportunity that is now starting to fulfill its potential. This remarkable growth of the IT sector can be attributed not only to well-established IT firms but also to a thriving community comprising 14,728 IT freelancers specializing in software development and technology, in addition to 51,781 ITeS freelancers actively exporting IT services through digital platforms.

The attraction of Nepal’s IT service export sector is unquestionable, attracting individuals from various educational backgrounds and providing promising income prospects. As the industry continues to thrive, it is increasingly becoming an appealing career choice for a wide range of people.

One of the most remarkable aspects of Nepal’s IT sector is its ability to embrace professionals from diverse backgrounds. Every year, approximately 9,000 graduates enter the job market, with around 7,085 of them finding opportunities in the IT sector. What’s even more impressive is that 35.3 percent of graduates from different fields are also finding their path into the IT industry, emphasizing its attractiveness and the potential it holds for career advancement.

The earning potential in the IT sector serves as another enticing factor that is luring individuals into this field. At the entry level, professionals can expect an annual salary of approximately USD 2,810, while mid-level experts earn around USD 6,395. Senior-level IT specialists can command an impressive annual income of up to USD 15,322.

Digital technologies have brought about a transformation in the way people and organizations work, enabling tech professionals to cater to clients both locally and globally through remote work arrangements. “This has eliminated geographical constraints and completely altered the conventional 9-to-5 work structure. Particularly during the Covid-19 pandemic, remote work and the gig economy gained significant traction, with approximately 66,509 freelancers adopting gig work as their primary, secondary, or supplementary source of income,” said Shrestha.

Challenges in Meeting Demand and Supply

Entrepreneurs and experts say Nepal’s IT industry confronts a significant and enduring challenge: a pronounced mismatch between the demand for IT professionals and the availability of qualified graduates. What exacerbates this issue is the government’s implementation of a quota system in Nepali IT colleges, whereas foreign university-affiliated colleges have the autonomy to admit as many students as they see fit. This incongruity not only impacts the quality of education but also leads to a substantial outflow of foreign currency as students flock to these foreign-affiliated institutions. According to Joshi, despite a high demand for IT professionals, the sector’s growth is constrained by government-imposed enrollment quotas on students, presenting a significant obstacle to the industry’s expansion.

The imposition of quotas in local IT colleges has stirred controversy, as it imposes limits on the number of students these institutions can enroll. Conversely, foreign-affiliated colleges continue to attract a substantial student population, enjoying more flexibility and less stringent regulations.

Nepal has seen a surge in educational institutions offering IT-related courses, further fostering the growth of a skilled workforce. However, there is room for improvement in aligning academic programs with industry needs, as indicated by some freelancers who felt that Nepal’s bachelor courses only barely met their required standard.

Presently, there are 110 educational institutions that have IT-related programs at undergraduate and graduate levels. These programs include Bachelor of Information Technology, Bachelor in Computer Science and Information Technology, Bachelor in Cyber Security and Digital Forensics, Master in e-Governance, Master in Information Technology Management, among others.

Umesh Rajbanshi, CEO of Info Developers, highlights a broader issue of brain drain in Nepal, with many seeking opportunities abroad. “Any successful business in Nepal is propelling young individuals to foreign countries. However, the IT sector stands out as a sector that retains young talent within Nepal, helping to mitigate the exodus. We are struggling in all aspects as youths predominantly aspire to go abroad,” he commented.

“Educational institutions today grapple with low enrollments. For instance, Kathmandu University has had to discontinue certain programs due to a lack of students. Human resources play a pivotal role in development, yet Nepal faces a deficit in producing qualified graduates. Where is the commitment to address this? We should not focus solely on numbers. Even if the IT industry is valued at USD 10 billion, the question remains: Where will we find the human resources to support it?” he questions.

Despite increasing opportunities in the local IT industry, professionals often leave in pursuit of better prospects abroad. Local IT companies have, in essence, transformed into training centers for talent that eventually migrate to other countries. This not only hinders the growth and sustainability of the domestic IT sector but also results in the loss of valuable human capital.

Despite increasing opportunities in the local IT industry, professionals often leave in pursuit of better prospects abroad. Local IT companies have, in essence, transformed into training centers for talent that eventually migrate to other countries. This not only hinders the growth and sustainability of the domestic IT sector but also results in the loss of valuable human capital.

According to Shrestha, the workforce required for a tech company increases with the growth and expansion of the business of the firm. “However, the current brain drain situation is impeding growth, and even successful companies in Nepal have become more like training institutions. Retaining human resources has become an immense challenge,” he opined.

To address these challenges, Nepal needs comprehensive reforms in its education sector and IT policies. Ensuring equal opportunities for local and foreign-affiliated colleges, investing in the quality of education, and creating an enabling environment for IT professionals to thrive within the country are pivotal steps, according to IT experts. By addressing these issues, Nepal can bridge the gap between the demand and supply of IT professionals, retain talent, and fortify its IT sector for sustained growth and development.

Dr. Amrita Sharma, the lead researcher of the IIDS report, echoes Shrestha’s concerns, emphasizing that Nepali IT companies are grappling with the shortage of human resources. She remarks, “With the government’s quota system in IT colleges, young individuals are opting to study in foreign university-affiliated colleges, further draining significant resources from Nepal.”

Infrastructure Remains a Hurdle

Despite the remarkable opportunities and exponential growth in Nepal’s IT service export industry, formidable challenges continue to hinder its progress. These challenges predominantly revolve around critical infrastructure, demanding immediate attention and reform to ensure the sector’s sustained success.

While the majority of companies, approximately 75.9 percent, expressed contentment with the quality of electricity services, a significant portion, about 23.4 percent, voiced dissatisfaction.

Their concerns stem from unannounced power cuts and unpredictable interruptions that have not only disrupted operations but also resulted in equipment damage. Freelancers, who often rely on a stable power supply for remote work, have faced personal setbacks due to abrupt power outages.

One of the most pressing challenges is internet connectivity. Just a mere 43.2 percent of companies and 36.4 percent of freelancers find the current internet services to be adequate. The majority believe that the existing infrastructure falls short of meeting their needs, which is a substantial obstacle given the sector’s reliance on robust internet access. Strengthening and improving the reliability of Internet services should be a top priority

The absence of a dependable data center within Nepal and the lack of a high-capacity information highway hinders the sector’s growth potential. Establishing reliable local data infrastructure is essential for data security and overall reliability, according to IT entrepreneurs.

According to IT businesses, establishing offices in Nepal is notably costly, affecting both established companies and startups. “The quality of available IT equipment, including hardware, servers, computers, and networking devices, is subpar. This impacts the efficiency and competitiveness of IT services. Also, the high cost of furniture and fixtures poses an unnecessary financial burden. The provision of free working spaces for IT startups could alleviate some of these challenges,” they say.

According to Dr. Sharma, IT infrastructure is often centered around Kathmandu, but even in the capital, internet quality remains a significant issue. “In terms of investment, companies in the IT sector can be categorized into three groups: those requiring seed funding, mid-sized companies, and larger enterprises,” she said.

The larger firms often serve as branch units or have foreign sales operations while maintaining their registration in Nepal for administrative purposes. Mid-sized companies are looking to expand beyond Nepal due to the limited domestic market size. To facilitate their growth, merging these firms like those of banks could be an effective strategy. According to Sharma, some mid-sized companies claim not to require additional funding, while others express the need for capital, although they may not meet the required compliance standards. “This mismatch between IT companies’ financing needs and the banking industry’s offerings results in a disconnect,” she said, adding that banks report a lack of demand for loans from the IT sector, while IT companies argue that banks do not adequately support them, primarily due to issues related to collateral. “The underlying issue here is the substantial gap between the financial needs of IT companies and the resources available through traditional banking channels.”

Policy Changes are a Must

Nepal has historically given limited attention to the IT industry, particularly in areas such as outsourcing and e-commerce. The lack of funding for early-stage financing and company incubation has hindered the growth of IT startups and the overall economy.

While the government has introduced initiatives such as the Digital Nepal Framework and the Master Plan for ICT in Education (2013-17), policies and legal frameworks concerning IT remain poor in comparison to most South Asian countries, especially in segments such as IT outsourcing and e-commerce.

The IT service export industry in Nepal confronts substantial challenges resulting from a lack of clear and up-to-date policies tailored to its unique needs. According to the study, a staggering 70 percent of respondents expressed dissatisfaction with Nepal’s policy framework for nurturing the IT sector. Several critical concerns have been raised, including inadequate protection of intellectual property, insufficient regulations concerning data privacy and security, and potential constraints on cross-border data flow as outlined in draft IT bills.

The IT service export industry in Nepal confronts substantial challenges resulting from a lack of clear and up-to-date policies tailored to its unique needs. According to the study, a staggering 70 percent of respondents expressed dissatisfaction with Nepal’s policy framework for nurturing the IT sector. Several critical concerns have been raised, including inadequate protection of intellectual property, insufficient regulations concerning data privacy and security, and potential constraints on cross-border data flow as outlined in draft IT bills.

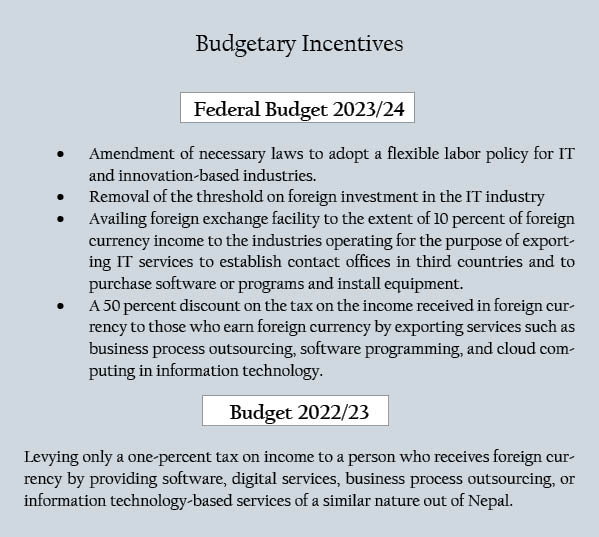

Nevertheless, there have been some positive shifts in government policies aimed at boosting IT service exports. In the federal budget for FY 2023/2024 budget, Finance Minister Dr. Prakash Sharan Mahat eliminated the minimum threshold for foreign direct investment (FDI) in the IT sector and offered a 50 percent tax relief for Business Process Outsourcing (BPO) companies exporting their services. Likewise, the monetary policy for 2023/24 aims to streamline foreign currency transactions for service exports, simplifying the process for IT companies to receive foreign earnings electronically. This policy also facilitates foreign exchange operations, enabling these companies to establish offices abroad, make payments to foreign entities, transfer funds overseas, and acquire necessary software or equipment. These budgetary changes have the potential to significantly uplift the IT service export sector. According to Joshi, the government’s decision to allow IT companies to open accounts in foreign countries is a positive step, creating a conducive environment for growth.”

However, certain tax relief measures do not extend to smaller IT companies or startups. Tax rebates are currently available to Nepali IT companies with 300 or more employees, which have limited impact on smaller firms and offer no incentives for tech startups with fewer staff. This poses a challenge, as many IT service companies in Nepal employ a limited workforce, ranging from 15 to 20 employees, with only a handful having more than 100 staff. The survey also revealed a limited understanding of policies and regulations among IT service export companies in Nepal.

Apart from taxation policies, labor laws that promote the well-being of workers in the IT industry are also crucial for creating a supportive work environment. The IIDS report has emphasized that laws must recognize the nature of work in the IT industry, which often involves flexible work arrangements such as remote work, freelance contracts, or project-based employment, and provide appropriate protections and benefits for workers engaged in such roles. “Revising the salary tax bracket for ICT professionals, easy mobility of workers, both domestically and internationally, through proper immigration policies can also aid in bringing skilled Nepali IT professionals to the forefront of the global IT landscape,” reads the report.

According to Joshi, In Nepal, distinguishing between digital and physical labor is crucial due to their vastly different natures. He says the government must develop labor policies that acknowledge these distinctions, recognizing the unique demands and opportunities of the IT sector. “Tailored policies can foster a favorable environment for IT professionals, aligning with the rapidly evolving nature of their work and promoting economic growth,” added Joshi.

“Nepal currently is in ‘Phase 1’ of its IT market development”

Over the past 20 years, Nepal’s IT sector has experienced substantial growth. Initially, it struggled to meet demands due to limited experience but has since evolved into a competitive industry. Numerous companies have expanded their services to international clients, enhancing their competence in delivering software and services. However, despite these advancements, Nepal currently is in what can be termed as ‘Phase 1’ of its IT market development.

Over the past 20 years, Nepal’s IT sector has experienced substantial growth. Initially, it struggled to meet demands due to limited experience but has since evolved into a competitive industry. Numerous companies have expanded their services to international clients, enhancing their competence in delivering software and services. However, despite these advancements, Nepal currently is in what can be termed as ‘Phase 1’ of its IT market development.

In order to progress into ‘Phase 2’ and unlock the full potential of the market, significant investments are essential, necessitating collaboration between the private sector and government. Partnering with larger corporations can offer stability, especially as long-term contracts become increasingly common, in contrast to the current situation where companies often face uncertain work opportunities from year to year.

To ensure the success of the Phase 2 transition, it is imperative to have policy-level backing and implement specific reforms. Moreover, boosting the influx of job-ready graduates into the labor market would greatly serve the industry by guaranteeing a proficient workforce. Presently, there is a pattern where young talents work locally for a brief period before pursuing opportunities abroad, exacerbating the instability in the domestic market. Tackling these issues and nurturing an environment conducive to growth are critical steps for Nepal’s market to advance into a more secure and prosperous Phase 2.

“The sector’s growth is constrained by government-imposed enrollment quotas on students”

The IIDS report reveals some intriguing facts, such as the presence of over 60,000 freelancers and more than 100 companies in Nepal’s IT sector. The most promising opportunity lies in the continuous expansion of the freelance workforce. The figures in the report are specific to the formal sector, which currently amounts to half a billion dollars. When we consider both the formal and informal sectors together, the industry’s size could exceed 1.5 billion dollars, showcasing significant potential.

The IIDS report reveals some intriguing facts, such as the presence of over 60,000 freelancers and more than 100 companies in Nepal’s IT sector. The most promising opportunity lies in the continuous expansion of the freelance workforce. The figures in the report are specific to the formal sector, which currently amounts to half a billion dollars. When we consider both the formal and informal sectors together, the industry’s size could exceed 1.5 billion dollars, showcasing significant potential.

However, to fully tap into this potential, the government must adopt a more dedicated and earnest approach. The government’s decision to allow IT companies to open foreign accounts is a step in the right direction, creating a favorable environment for growth. Freelancers encompass a diverse array of professionals, extending beyond software development for foreign companies. This group includes individuals who generate income through platforms like TikTok, YouTube, and other social media sites. It is crucial for Nepal to distinguish between digital and physical labor, and the government should address labor policies accordingly, recognizing the unique nature of this work compared to traditional IT professions.

Leapfrog, an outsourcing company that offers cost-effective software development services to overseas clients, also addresses the challenges faced by IT companies and freelancers when repatriating earnings from abroad. We have developed a fintech solution called Xuno to facilitate formal channels for transferring earnings earned overseas. Despite a high demand for IT professionals, the sector’s growth is constrained by government-imposed enrollment quotas on students, presenting a significant obstacle to the industry’s expansion.

“Government officials are not fully aware of the quality of software produced by Nepali professionals”

TThe IIDS report has illuminated positive developments within Nepal’s IT sector. It’s important to recognize that the actual size of the IT market surpasses the figures outlined in the report. Furthermore, when we encompass the industry in its entirety, including both the local and international markets, the scale becomes even more substantial. While the IT sector may have previously operated somewhat under the radar, the IIDS report has effectively brought its immense potential to the attention of policymakers. When we factor in both domestic and export components, the true size of Nepal’s IT industry exceeds USD 2 billion, marking a remarkable growth trajectory.

TThe IIDS report has illuminated positive developments within Nepal’s IT sector. It’s important to recognize that the actual size of the IT market surpasses the figures outlined in the report. Furthermore, when we encompass the industry in its entirety, including both the local and international markets, the scale becomes even more substantial. While the IT sector may have previously operated somewhat under the radar, the IIDS report has effectively brought its immense potential to the attention of policymakers. When we factor in both domestic and export components, the true size of Nepal’s IT industry exceeds USD 2 billion, marking a remarkable growth trajectory.

Nepali IT companies have been predominantly engaged in projects abroad, focusing on software development, database management, and CRM. The United States stands out as the primary client for Nepal’s IT industry, given its status as the largest global market. In recent times, other countries such as Japan, Australia, the Middle East, and South East Asia have also emerged as potential markets for Nepali IT firms.

Our company, Rara Labs, employs 150 staff and operates in various sectors. We undertake international client projects and invest in software products. One of our notable products is Tigg, a cloud-based accounting solution.

It’s crucial to highlight that government officials are not fully aware of the quality of software produced by Nepali professionals. They might not even realize that major entities like Boeing, one of Japan’s largest e-commerce platforms, and a significant money transfer company, have utilized software developed by Nepali IT engineers.

In the near future, Nepali companies may face a shortage of skilled personnel due to the increasing trend of workforce migration from Nepal. To address this issue, the government could consider advocating for the formation of consortiums among Nepali companies to collaborate on substantial projects, thereby encouraging Nepali youth to remain in the country. Even today, the Nepal government procures software and IT services worth Rs 20 billion. If a portion of this work is allocated to Nepali companies, it could gradually reverse the trend of talent leaving the country.

Another noteworthy issue concerns the transfer of funds abroad for marketing or promoting products. Several companies operate both in Nepal and abroad, and there’s a need for intervention in this regard. It would be beneficial to allow a certain percentage of these transactions for marketing efforts in the international market.

“Brain drain poses a broader challenge to the IT sector’s growth”

InfoDevelopers mainly serves the domestic market which accounts for 85 percent of our work. The current state of Nepal’s IT industry represents just the initial stages of what promises to be substantial growth. In the banking and financial sector, InfoDevelopers holds a significant 65 percent of the market share. Over the years, our company has catered to the needs of government and public institutions, including the Ministry of Commerce and Industry, the Company Registrar Office, the Inland Revenue Department, and the Citizen Investment Trust. Additionally, we are actively engaged in a centralization project for citizenship records with the Home Ministry.

InfoDevelopers mainly serves the domestic market which accounts for 85 percent of our work. The current state of Nepal’s IT industry represents just the initial stages of what promises to be substantial growth. In the banking and financial sector, InfoDevelopers holds a significant 65 percent of the market share. Over the years, our company has catered to the needs of government and public institutions, including the Ministry of Commerce and Industry, the Company Registrar Office, the Inland Revenue Department, and the Citizen Investment Trust. Additionally, we are actively engaged in a centralization project for citizenship records with the Home Ministry.

We have now expanded our services to international markets, emphasizing insourcing over outsourcing. This approach entails developing solutions in-house and exporting them beyond Nepal. We have operations in Bhutan and Myanmar, where microfinance banks in Bhutan and a bank in Myanmar are using our Pumori software. We are also exploring opportunities to further expand our presence in East Asian countries.

InfoDevelopers is also working on launching core banking products and plans to introduce world-class products to international markets. Presently, our Pumori software is utilized by three A-class banks—Prime Commercial Bank, Rastriya Banijya Bank, and Nepal Bank. Additionally, all development banks and finance companies rely on the Pumori software, with a total of 35 BFIs utilizing it.

Our company, which was founded two decades ago with just three individuals, has now grown to employ more than 350 staff members. We recently received an offer from a Japanese company but had to decline due to the need for 350 IT professionals, which we currently do not have the capacity to provide.

Brain drain poses a broader challenge to the IT sector’s growth. This trend is becoming increasingly evident as educational institutions struggle with low enrollments. For instance, Kathmandu University has been forced to discontinue certain programs due to a lack of students. Human resources play a pivotal role in driving development, yet Nepal is grappling with a shortage of qualified graduates. This situation underscores the critical importance of investing in education and skill development to promote economic growth and reverse the trend of youth emigrating from the country.